Annual Shutdown & Christmas Donations

Welcome to our last update for the 2020 year. The team at Coastal Accounting would like to take this opportunity to thank you for your support this year – it has certainly been a strange and challenging year.

This year, instead of providing our clients with personalized Christmas cards, we decided we would again donate to our chosen Charity: Women’s Refuge Whangarei. We would like to thank all of you who also contributed towards this.

With the holidays just around the corner, our team are working hard to have everything completed for you, (let’s call it an early gift from us to you) before heading off for Christmas break.

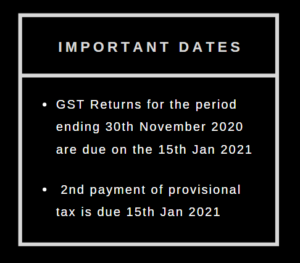

We have included some important dates and tax updates below, please lock those dates into your calendars and if you have questions please get in touch with us.

Our office will be closed from mid-day on Wednesday 23rd of December and re-opening, Monday the 11th of January 2021. We will be responding to our emails and voice messages as soon as we return. If your matter is urgent, please call us on the numbers below:

- Hazel – 027 501 9691

- Linelle – 021 062 8286

- Katrina – 021 657 928

We wish you a Merry Christmas and a safe and festive New Years! See you later 2020 – hello 2021!

– The Coastal Team

__________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________

Low-value asset threshold raised to $5K for depreciation

When you buy small value assets the IRD have raised the threshold level for depreciation from $500 to $5000 (+ GST).

This means that you can immediately write off any asset that costs less than $5,000 that was purchased on or after 17 March 2020.

This threshold has been increased, effective from 17 March 2020, to allow the immediate expensing of assets that cost up to $5,000. This increase is temporary and will only apply until 16 March 2021. After this date the low-value asset threshold will increase permanently, but only to $1,000 (+GST).

__________________________________________________________________________________________________________________________

39% Personal Tax Rate Legislation Introduced

The Government has introduced legislation for the 39% personal tax rate on income above $180,000.

The new rate will apply from 1 April next year (the 2021-22 income year). We will be in touch with you if we believe you would benefit from tax planning. However, if you would like to discuss this with us, please get in touch via phone or email today.

__________________________________________________________________________________________________________________________

Changes to Small Business Cashflow Scheme

The Government has announced some changes to the Small Business Cashflow (Loan) Scheme.

- No interest will be charged if the loan is repaid within 2 years. Initially it was 1 year.

- Restrictions on how the loan can be used have eased. As well spending on core operating costs, businesses will be able to choose to use the loan to invest in their business helping it to adapt to the impact of COVID-19.

Also, applications for the loan can now be made until 31 December 2023, an extension of 3 years.

__________________________________________________________________________________________________________________________

Builders 10 Year Rule – Need to know

If you sell a property within 10 years of buying it or, in the case of builders, within 10 years of completing improvements to it you may have to pay income tax on the profits.

Even if the property was not purchased as part of the business you may still have to pay tax.

If you are in these industries or associated to someone who is, we recommend you speak with us to find out how these rules apply to you.

__________________________________________________________________________________________________________________________