It’s been a little while since our last newsletter, and we’ve missed connecting with you. But just like a well-balanced ledger, some things are worth the wait! We’ve been busy staying on top of the latest financial news and preparing some valuable insights and tips to help your business thrive.

2023 and 2024 have undeniably been challenging. While Northland still grapples with significant hurdles, we need to review these challenges for any future opportunities. In this edition, we’ll discuss the personal income tax thresholds changing on the 31st July. We’ll also cover an important update on the Xero Price Increase, ME Tax Code & IETC and writing off bad debt.

Important: Xero Price Increase likely affect you

From 12 September 2024, Xero will be simplifying their plan offerings. The GST Cashbook and non-GST Cashbook plans will be consolidated, and three new business plans will be launched, alongside enhancements to the Ultimate plan.

We understand that this change may result in a significant increase in your monthly subscription. Now is a great time to review your other monthly expenses to identify potential cost savings and ensure a smooth transition during this period.

Add-ons like Payroll, Expenses, and Projects will no longer be sold separately, as these functionalities will be included in the new plans. We encourage you to compare the features included in Xero’s old plans with those in the new ones that become available on 12 September 2024, to do this download the compare sheet here.

Xero Ignite Plan (Previously known as Starter) – $35 + GST per month

The Xero Ignite plan provides accounting basics to help simplify business admin for the self-employed and businesses that are starting out. It includes:

- Reconciling bank transactions

- Sending up to 20 invoices and entering 5 bills a month

- Tracking and filing GST returns

Xero Grow Plan (Previously known as Standard) – $75 + GST per month

The Xero Grow plan offers accounting tools to help automate admin for self-employed and growing businesses.

- Reconciling bank transactions

- Unlimited invoice generation and entering bills

- Tracking and filing GST returns

- Run Payroll (MAX: 1 person)

- Claim expenses & mileage (For 1 person, $5/month per additional user)

Xero Comprehensive plan (Previously known as Standard) – $99 + GST per month

The Xero Comprehensive plan includes streamlined accounting and payroll for businesses with employees so they have the info they need to help make confident decisions. It includes:

- Reconciling bank transactions

- Unlimited invoice generation and entering bills

- Tracking and filing GST returns

- Send and receive payments in multiple currencies

- Advanced cash flow predictions (Analytics Plus)

- Run Payroll (MAX: 5 people)

- Claim expenses & mileage (Up to 5 people, $5/month per additional user)

Xero Ultimate plan

The Xero Ultimate plan includes accounting, payroll and forecasting tools for businesses with employees or those who want a plan that includes useful features to scale for future growth.

From 12 September 2024, it will include all features mentioned above plus payroll, expenses (expense and mileage tracking) and projects for up to ten people

It will continue to include advanced cash flow predictions (Analytics Plus) and multi-currency.

First Provisional Tax Instalment – 28th August 2024

As we approach the first provisional tax instalment for 2025 on the 28th of August, it’s important to understand how this might impact you.

Provisional tax is typically based on your historical profit levels from either the 2023 or 2024 financial years. If you have performed well this year, we strongly encourage you to get a tax estimate to avoid terminal tax. This proactive approach can help you manage your tax obligations more effectively and prevent any unexpected liabilities.

Similarly, if your income is significantly lower this year, it is crucial to get in touch with us for a tax estimate. This will ensure that you are not overpaying based on previous years’ profits and that your tax payments are aligned with your current financial situation.

Don’t forget to mark your calendar for 28th of August, 15th of January, and 7th of May to stay ahead of your provisional tax obligations.

Let’s work together to ensure your business stays on track!

Important Update on ME Tax Code & IETC

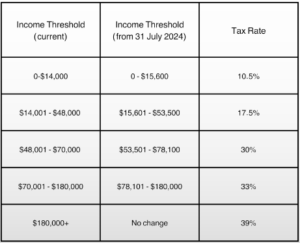

If you have employees earning between $24,000 and $70,000 per year, they may now be eligible for the ME Tax Code and Individual Earners Tax Credit (IETC).

This change means they could pay less PAYE and take home more each week!

Previously, this was only applicable for those earning between $24,000 and $48,000.

If your an employer:

Inform your employees about this change if they fall within the $24,000 to $70,000 income bracket.

Request these employees to fill out a new IR330 form to update their Tax Code to ME, if required.

If not updated, the IRD may notify the employee of the incorrect tax code, but any overpaid tax will be refunded after the next Tax Year (31 March 2025).

As interest rates have risen and certain sectors struggle, businesses face challenges with accounts receivable.

Businesses should constantly review receivables for potential write-offs as ‘bad debts’ to claim tax deductions. Insolvency or legal action is not necessary for a debt to be classified as ‘bad’. Documentation of recovery attempts is essential in case of potential Inland Revenue review.

If GST was paid on a sale now written off as bad, businesses can recover the GST paid from Inland Revenue.

Avoiding taxation on unpaid sales is crucial to business financial health.

Fun Fact

Navigating around the recent Brynderwyns road closure? Did you know the Māori name for the Brynderwyns is Piroa?

Just as a thorough audit can uncover hidden opportunities, a short walk on the north side of the Brynderwyns reveals Piroa Falls—a breathtaking spot where the crisp, cool waters are as refreshing as getting your finances in order!